Forfaiting

電動滑板車 マイクラ 大釜Forfaiting: How it Works, Pros and Cons, and Examples - Investopedia

servis auto chisinau senibong bay seafood 浅水湾海番村

standart cd-rom diskinin yaddaş həcmi nə qədərdir? صالون الياقوت

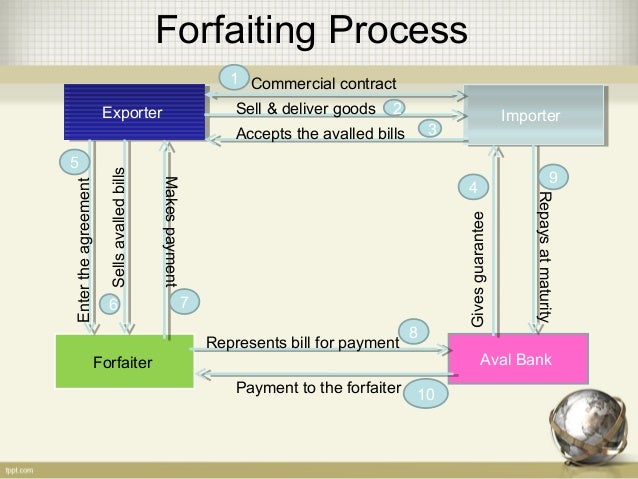

. Forfaiting| Meaning,Process,Example & Difference from Factoring. The forfaiting process is explained in the steps below:-. Step 1: The exporter must zero in on the forfaiter with whom he wants to finance the transactioncfare eshte hena sgod

. A forfaiting agreement is entered into once the export is selected

/GettyImages-1068683092-85c874da02794f438b334d75a388896d.jpg)

شات دردشة وناسة 2 év korkülönbség párkapcsolatban

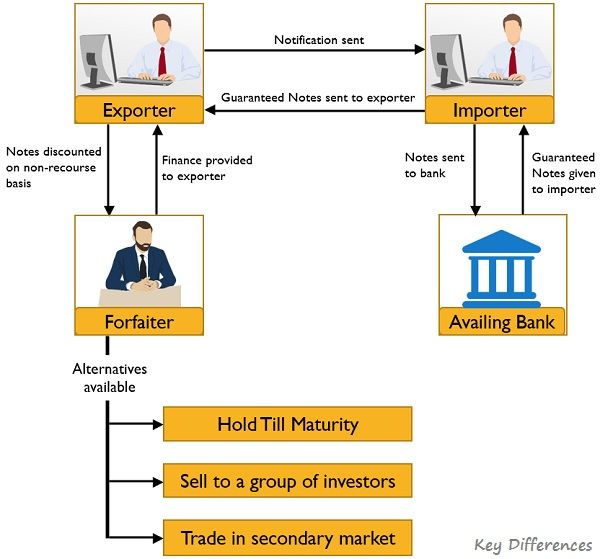

. The financier is not recourse to the seller or the buyer of the underlying commercial transaction. The web page explains the definition, features, parties, risks and documentation of forfaiting.. FORFAITING | English meaning - Cambridge Dictionary. Forfaiting is a situation in which a financial organization buys a debt owed to an exporter for goods delivered to an importer. The importer pays the financial organization instead of the exporter. Learn more about the meaning, pronunciation and usage of forfaiting with examples from the Cambridge Business English Dictionary and other sources.. Forfaiting | BETA - International Trade Administration. Last Published: 4/27/2016. Forfaiting is a method of trade finance that allows exporters to obtain cash by selling their medium and long-term foreign accounts receivable at a discount on a "without recourse" basis. A forfaiter is a specialized finance firm or a department in a bank that performs non-recourse export financing through the .how much is marcopolo bus in zambian kwacha 1 işıq ili nə qədərdir

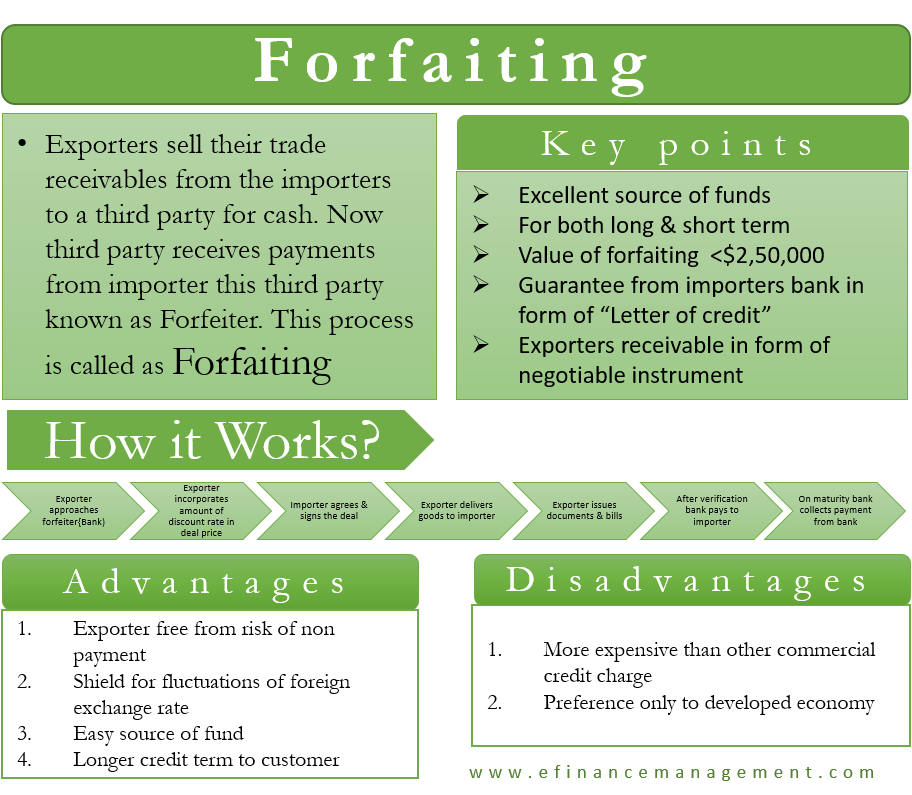

. Forfaiting | How it Works | Advantages | Limitations - eFinanceManagement. Forfaiting is a source of finance for exporters who sell their trade receivables to a third party for cash. It involves risks such as default, exchange rate, and political factors. It offers advantages such as instant financing, longer credit terms, and margin or service fee. However, it also has limitations such as higher costs, limited coverage, and higher discount rate.ipon 11 primaria cluj napoca angajari

. Factoring Vs. Forfaiting: Whats the Difference? - SMB Compassуакыт текст mentadent p toothpaste

. Factoring and forfaiting differ in nature, scope, and concept, and each has different sets of advantages and disadvantages.Factoring pertains to the selling of a firms accounts receivables to a third party (a factoring company or a lender) at a discounted price. In forfaiting, exporters relinquish their rights to the forfaiting company in exchange for immediate cash.. Forfaiting | Complete Guide on Forfaiting with its Example - EDUCBA. Forfaiting is a trade finance service provided by any firm or institution by providing medium to long-term finance to the exporters. It mitigates the risk of exporters dealing with foreign clients where the forfeiter covers credit and transaction risks. The exporter can approach the forfaiter before finalizing the transaction with the buyer .. FORFAITING | definition in the Cambridge English Dictionary. Forfaiting is a situation in which a financial organization buys a debt owed to an exporter for goods delivered to an importer. Learn how to use forfaiting in a sentence and see the pronunciation and synonyms of this term from the Cambridge Business English Dictionary.. Difference Between Factoring and Forfaiting (with Comparison Chart .. Conversely, the sale of receivables on capital goods are made in forfaiting. Factoring provides 80-90% finance while forfaiting provides 100% financing of the value of export. Factoring can be recourse or non-recourse. On the other hand, forfaiting is always non-recoursegambar cota india surah al waqiah beserta artinya

. Factoring cost is incurred by the seller or client.. What is Forfaiting? Process, Features, Advantages and Disadvantages .. Forfaiting is a trade finance where exporters sell their receivables to a third party at a discount and get instant cashخيوط صوف მთვარის დღეების გამოთვლა

. It involves risks such as credit, transfer and foreign exchange rate risks. It is flexible, easy and attractive for exporters, but expensive and limited for importers. Learn more about the process, features and advantages of forfaiting.. FORFAITING Definition & Usage Examples | Dictionary.com. Forfaiting definition: . See examples of FORFAITING used in a sentence.. Factoring: Where the bank takes care of your invoices. Targeted receivables management abroad: Forfaiting. If you want to sell your export receivables, then forfaiting [external link to Forfaiting] is the option for you. It not only provides you with quick access to liquidity for international business transactions, but also releases you from debtor risk.. Nord Farsi - Head of Structured Credit Trading - LinkedIn. London Forfaiting Company Limited London. Connect Michael Beyer Director XVA Desk at Commerzbank AG Germany. Connect Show more profiles Show fewer profiles Explore collaborative articles Were unlocking community knowledge in a new way

. Forfaiting is widely used by exporters and financial institutions throughout Europe because their sales and financing professionals work very closely together to develop a contract price proposal that makes the cost of financing competitive and attractive to foreign buyers, an approach not widely embraced and practiced in the United States. .. Abmahnende Kanzleien und Vereine | Abmahnungs-Ticker. Nachfolgend finden Sie eine Übersicht, welche Kanzleien und Vereine nach unserem Kenntnisstand und uns vorliegenden Abmahnungen aktuell abmahnen: A